Last weekend’s annual Keller Williams Mega Agent Camp in Austin, Texas gave insight into the 2023 economy and the implications for the national real estate market. In their presentation, Keller Williams provided statistics on GDP, inflation, recession probability, and explained real-life examples of how interest rates are affecting consumers’ buying power.

For many, 2023 has been a waiting game. Is the recession coming? When will interest rates finally come down? When will inflation stabilize? This report puts our current economic metrics into a historical context. However, despite all of the statistics, the future is yet to be determined.

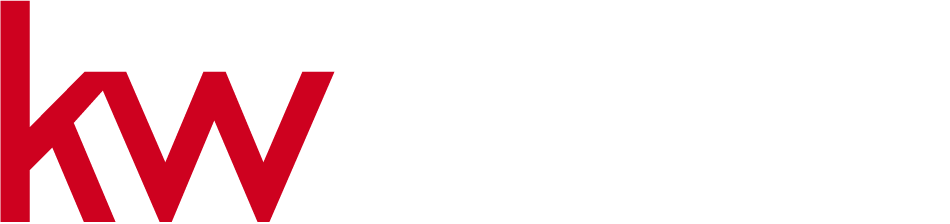

As of August of 2023, the New York Federal Reserve deems the likelihood of an upcoming recession in the United States at over 70%. The last time the probability ticked this high was before the recession of the early 1980s which stemmed from tight monetary policy aimed at reducing inflation, as is the case in today’s economy.

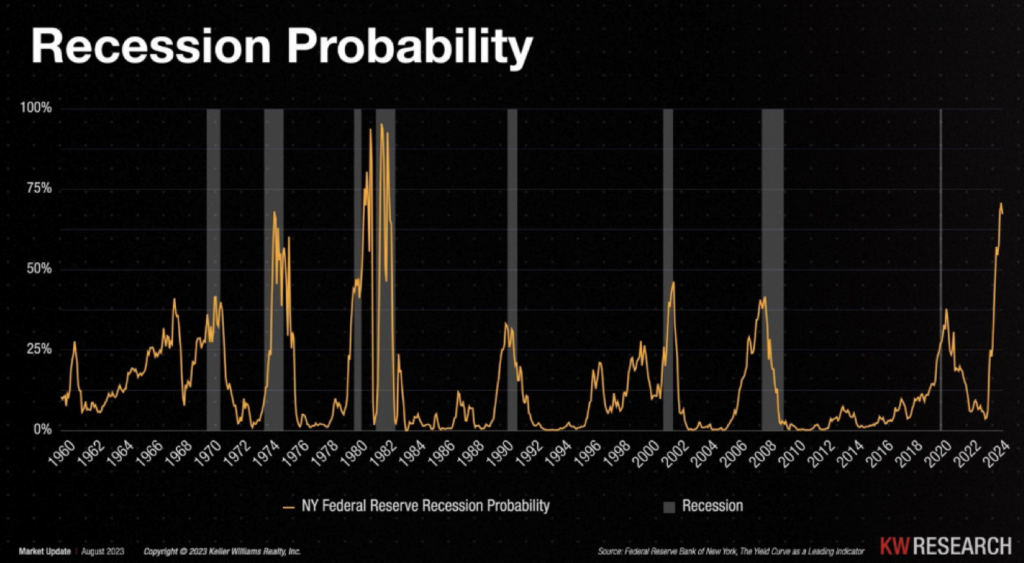

The Federal Reserve’s interest rate hikes were designed to bring inflation back down to 2%. Inflation soared in 2020 due to an infusion of cash into the market along with very low interest rates. Now, the economy is feeling repercussions.

Clearly, inflation is an increasingly popular topic. Let’s take a look at how real estate is performing in this economy.

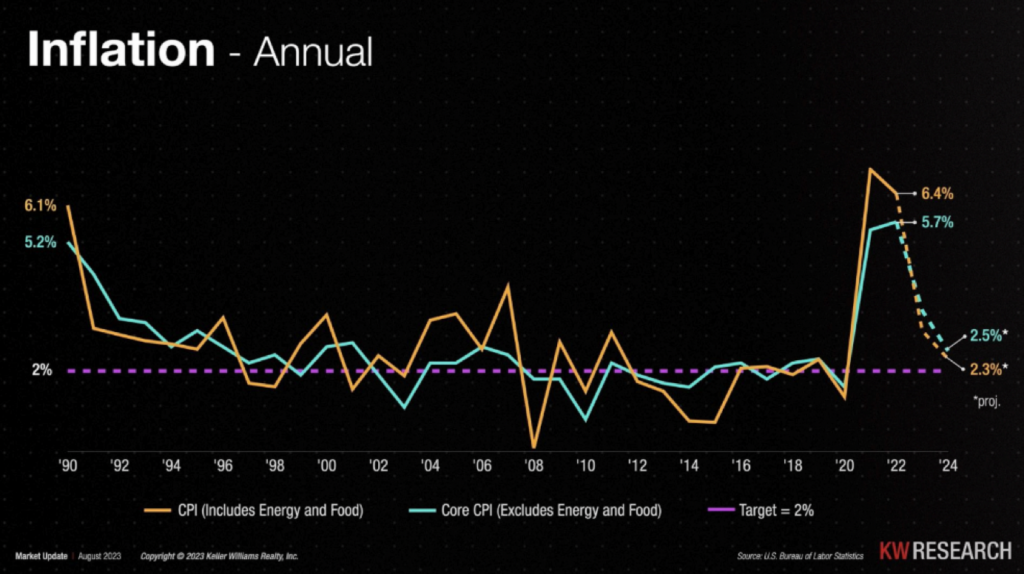

Interest rates have risen dramatically in the last 3 years due to the Fed’s deflationary monetary policies. Today’s rates are the highest since 2007. However, this graph shows that over a longer historical context, today’s interest rates are not unprecedented.

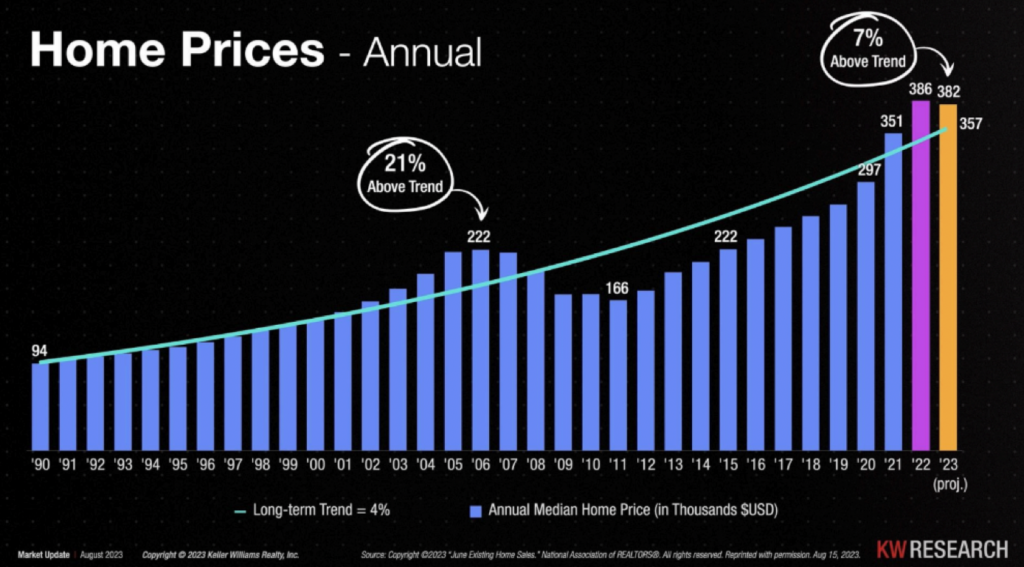

Over the last 3 years, home prices have exceeded the historical trend of appreciation. The latest spike occurred from 2020 to 2021. Since then, prices have slowly begun to drop towards the long-term trend of 4% appreciation.

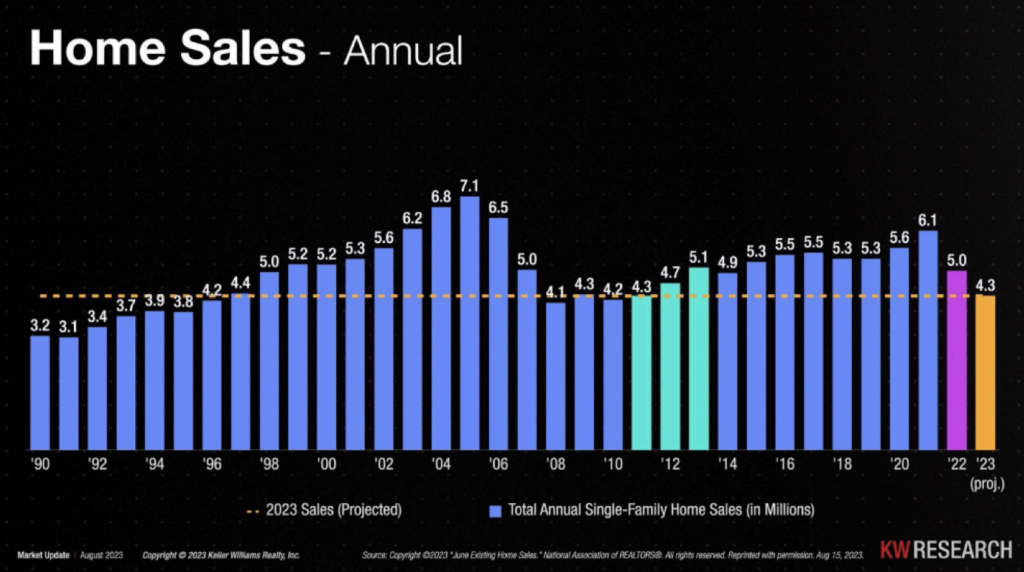

As expected, increasing interest rates have reduced buyers’ leveraged purchasing power. Prices however remain high. As a result, total sales are down nationwide. Once debt becomes affordable and prices begin to settle back to average appreciation rates, it’s likely that transactions will regain traction.

Reach out to Keller Williams Jackson Hole to learn more about how these nationwide trends are affecting Jackson Hole and the greater Teton region.